Introduction to W-2 Forms

Are you curious about what information is contained in a W-2 form? Whether you’re an employer or employee, understanding the details found on this essential document is crucial. From basic personal information to important figures for tax purposes, the W-2 form holds key insights into your financial status. In this blog post, we will explore the ins and outs of the W-2 form Generator, helping both employers and employees decipher its contents. So grab a cup of coffee and let’s dive into the world of W-2 forms together!

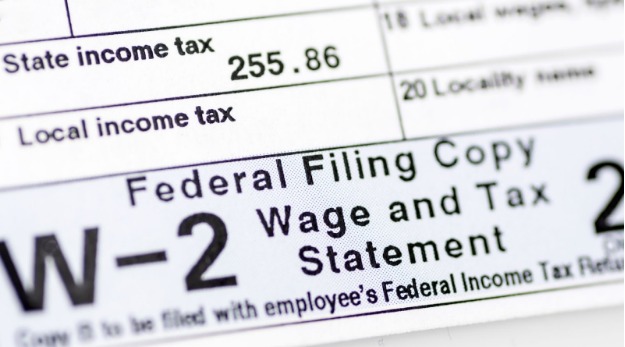

Basic Information Included in a W-2 Form

A W-2 form is an essential document that summarizes the income you earned and taxes withheld throughout the year. It provides vital information for both employees and employers when it comes to filing tax returns accurately.

The first section of the W-2 form contains basic details such as your name, address, and social security number. This ensures that the correct individual is associated with the earnings reported on the form.

Next, you will find boxes reporting your wages and tips for federal income tax purposes. These include your total taxable wages, tips received, and any other compensation like bonuses or commissions. Additionally, there are separate boxes indicating how much federal income tax was deducted from your paycheck during the year.

Another crucial aspect of a W-2 form is box 3 which states your Social Security wages for calculating contributions to Social Security benefits. Box 5 reports your Medicare wages along with any additional Medicare taxes withheld if applicable.

Furthermore, you’ll come across various codes in box 12 that represent different types of compensation or benefits such as retirement plan contributions or health insurance premiums. These codes help provide a detailed breakdown of your earnings beyond just regular wages.

Box 15 includes state-specific information relating to state income taxes withheld and employer identification numbers required for state reporting purposes.

By understanding the basic information included in a W-2 form, individuals can effectively assess their annual earnings while preparing their tax returns accurately without overlooking important details. Employers also benefit from ensuring accurate completion of these forms to maintain compliance with IRS regulations.

How to Read and Understand a W-2 Form?

So, you’ve got your hands on a W-2 form. Now what? Don’t panic! Understanding this important document is easier than it seems. Let’s break it down step by step.

First up, take a look at the basic information section. This includes details like your name, address, and Social Security number – all essential for accurate reporting. Double-check these details to ensure they’re correct.

Next, pay attention to Box 1 – “Wages, Tips and Other Compensation.” This figure represents your total taxable income for the year. It includes not only your regular salary but also any bonuses or commissions you received.

Moving on to Box 2 – “Federal Income Tax Withheld.” Here you’ll find how much federal tax was deducted from your paycheck throughout the year. Remember that this amount contributes towards settling your annual tax liability.

Box 3 shows your total wages subject to Social Security taxes while Box 4 displays the amount of Social Security taxes withheld from those wages in that specific year.

In Boxes 5 and 6 respectively, you’ll find similar information related to Medicare taxes: total wages subject to Medicare taxes (Box 5) and the actual amount withheld (Box 6).

The remaining boxes contain additional relevant information such as state income tax withholdings (Box 17) or employer-sponsored retirement plan contributions (Box12). Familiarize yourself with these sections as well.

Understanding a W-2 form is crucial for accurately filing your taxes each year. By taking the time to review each box carefully, you can ensure that everything is in order before submitting them!

Remember though; I’m just scratching the surface here! There’s more valuable data contained within a W-2 form that may be applicable depending on individual circumstances. If you have any doubts or need further assistance interpreting specific aspects of your W-2 form, consider seeking advice from a tax professional.

Importance of Accurate W-2 Forms for Employers and Employees

Accurate W-2 forms play a crucial role in the financial lives of both employers and employees. These forms provide essential information about an employee’s earnings, taxes withheld, and other important details that are necessary for tax filing purposes.

For employers, ensuring the accuracy of W-2 forms is not just a legal requirement but also helps maintain transparency and trust with their workforce. Timely and accurate issuance of W-2 forms demonstrates professionalism and commitment to compliance.

Employees rely on these forms to accurately report their income when filing their annual tax returns. Any errors or discrepancies can lead to delays in processing tax refunds or even trigger audits by the Internal Revenue Service (IRS). By carefully reviewing their W-2 form, employees can identify any inaccuracies early on and take appropriate steps to rectify them.

Accurate W-2 form Generator also play a vital role in determining eligibility for various government benefits such as social security benefits or income-based loan programs. Inaccurate reporting may result in individuals missing out on these entitlements or facing unnecessary complications when availing them.

Accurate completion of W-2 forms ensures compliance with tax regulations, maintains trust between employers and employees, avoids potential penalties from the IRS, facilitates smooth processing of tax returns, and enables individuals to access entitled benefits without hassle.

Common Mistakes to Avoid on W-2 Forms

Filling out a W-2 form can be a daunting task, especially if you’re not familiar with the process. However, it’s crucial to avoid making common mistakes that could lead to unnecessary complications and delays. Here are some pitfalls to watch out for when completing your W-2 form Generator.

Double-checking your personal information is essential. Any errors in your name, social security number, or address can cause issues down the line. Make sure everything is accurate and up-to-date before submitting the form.

Another mistake to avoid is misclassifying yourself as an independent contractor instead of an employee or vice versa. This classification determines how taxes are calculated and reported. If you’re unsure about your status, consult with your employer or seek professional advice.

Additionally, accurately reporting income is vital. Ensure that all wages earned during the tax year are correctly entered in the appropriate boxes on the form. Failure to report all income can result in penalties from the IRS.

Moreover, pay attention to withholding information. It’s important that you provide accurate details about federal and state income tax withheld from your paycheck throughout the year. Incorrect figures may lead to discrepancies when filing your tax return.

Failing to sign and date your W-2 form is a common oversight but one that should be avoided at all costs! Your signature verifies that all information provided is true and complete.

By being aware of these common mistakes and taking extra care when filling out your W-2 form, you can ensure its accuracy and prevent potential headaches come tax time

How to Obtain a Copy of Your W-2 Form

So, you’ve misplaced your W-2 form and now you’re in a panic. Don’t worry, it happens to the best of us! Luckily, there are a few different ways you can obtain a copy of your W-2 form Generator without too much hassle.

It’s important to contact your employer. They should be able to provide you with another copy of your W-2 form or at least point you in the right direction for obtaining one. Keep in mind that some employers may charge a fee for providing additional copies.

If reaching out to your employer doesn’t work, don’t fret just yet. You can also request a transcript from the IRS by filing Form 1099. This will allow you to get information from any tax return filed within the past four years.

Another option is to use an online service like TurboTax or H&R Block. These platforms often have access to electronic versions of your previous tax returns, including your W-2 forms. Just make sure you have all the necessary information handy when using these services.

If all else fails, consider contacting the Social Security Administration (SSA). They keep records of reported wages and can provide you with earning statements which may include details from your lost W-2 form Generator.

Remember that obtaining a copy of your W-2 form may take some time and effort on your part but stay persistent! It’s crucial for accurate tax filing and ensuring that all necessary documents are accounted for.

Conclusion

Understanding the intricacies of a W-2 form is crucial for both employers and employees to ensure accuracy and compliance with tax regulations. Employers must diligently complete and distribute W-2 forms, while employees should carefully review them for errors before filing taxes. Simple mistakes can lead to penalties and delays in tax processing. In case of a lost W-2 form, contacting the employer or IRS for a duplicate copy is advisable. Being informed about W-2 forms empowers individuals to manage finances responsibly and navigate tax season with confidence.