Our Services

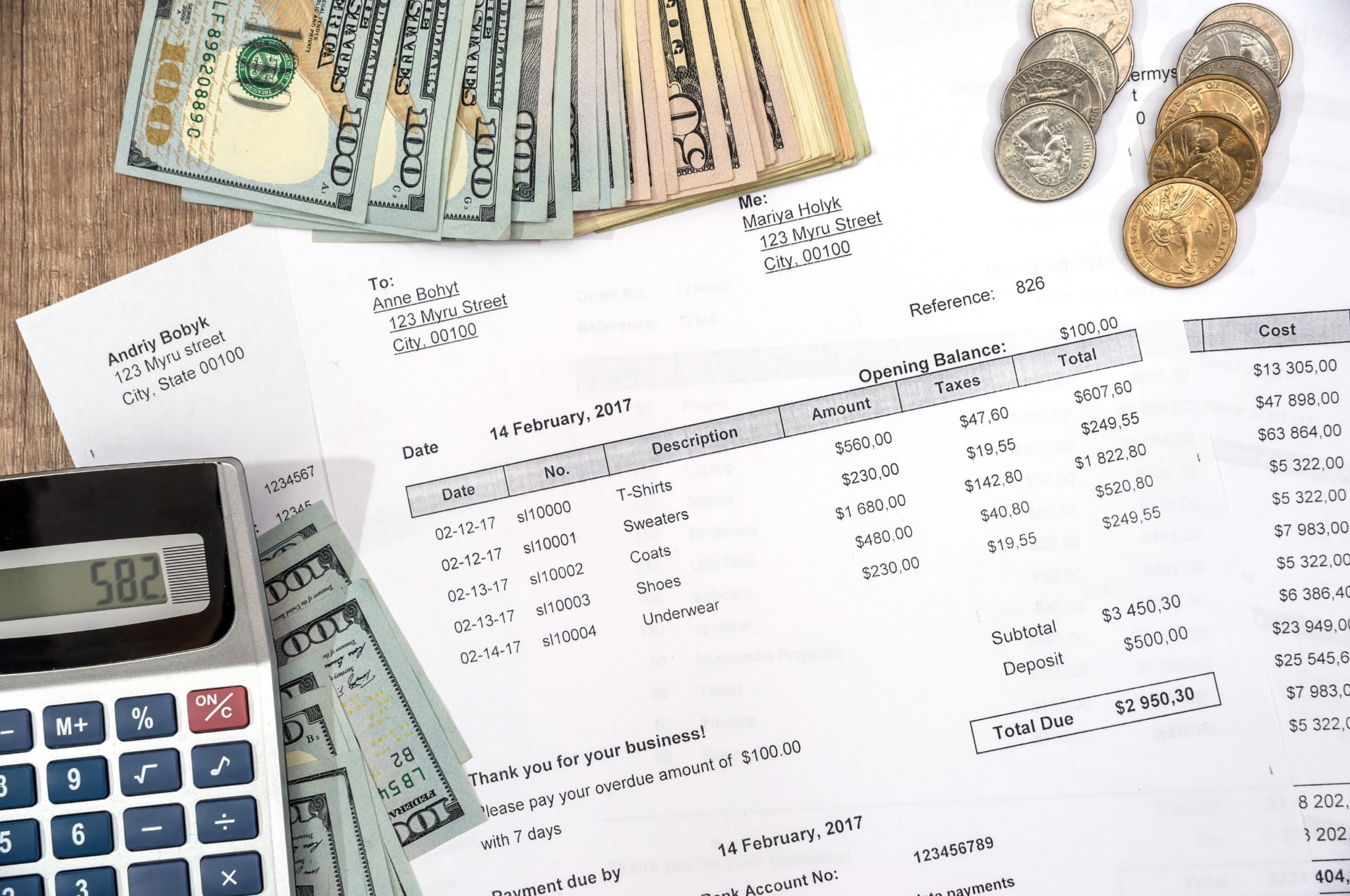

The Paperwork Hassle

The tedious process of paperwork and document management can be overwhelming and time-consuming.

Inaccurate Information

Dealing with incorrect or outdated information in bank statements and other important documents is frustrating and can lead to complications.

Lost or Missing Documents

Misplacing or losing important paperwork like pay stubs or tax forms can cause delays and create unnecessary stress.

Confusing Paperwork

Trying to understand complex documents like W9, W-2, and 1099 forms can be confusing and time-consuming.

Limited Access

Finding a reliable and accessible source for obtaining important financial documents can be a challenge.

Bank Statements

Authentic bank statements serve as crucial financial documents, providing a comprehensive record of an individual’s or business’s financial transactions over a specific period. These statements are typically issued by financial institutions, detailing account balances, transaction history, and other essential financial information.

Pay Stubs

Detailed pay stubs are essential documents that provide a comprehensive breakdown of an individual’s earnings and deductions associated with their employment. These documents serve various purposes, offering transparency and clarity regarding financial transactions between employers and employees.

W-2 Forms

The W-2 form is a critical document that employers must provide to their employees and submit to the IRS, detailing an individual’s annual wages and the taxes withheld. Ensuring the accuracy and thoroughness of W-2 forms is crucial for both employers and employees to facilitate seamless tax compliance.

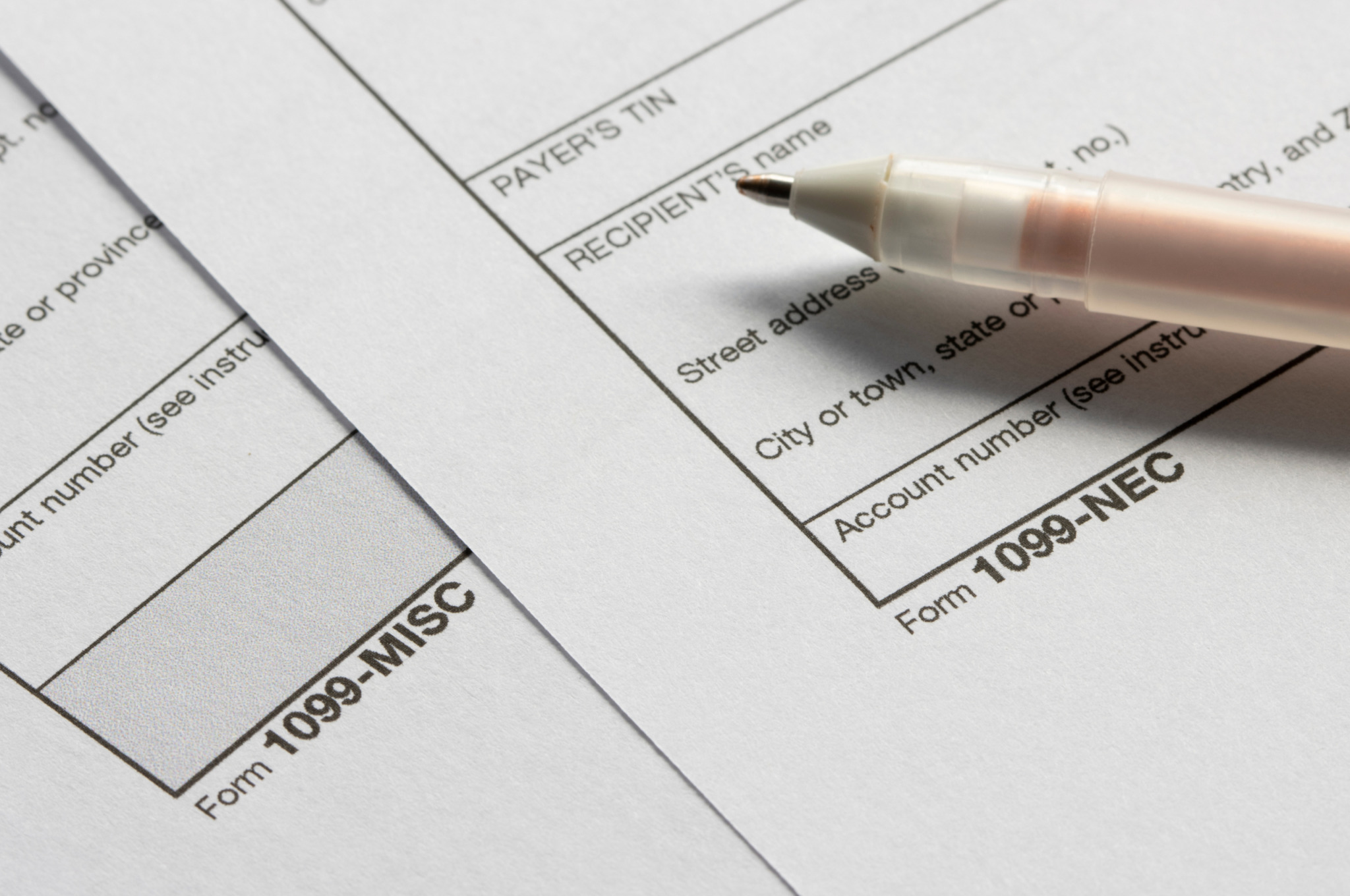

1099 Forms

The 1099 series of forms are crucial for reporting various types of income, aside from wages, to the IRS. These forms ensure accurate tax reporting for individuals or entities receiving payments outside of traditional employment relationships.