Online Paystub Generator

What is Pay Stub?

A pay stub is a document that serves as proof of your income and employment. It’s essentially a breakdown of your earnings and deductions for a specific pay period. Whether you’re a full-time employee or a freelancer, having a pay stub is crucial for various financial transactions, such as applying for a loan, renting an apartment, or managing your taxes.

PaperworkMaster exceeded my expectations! The quality of their work is top-notch, and the turnaround time was impressive.

James Anderson

What is Paycheck Stub?

The paycheck stub includes specific details about the pay period. It includes salary, hourly wages, overtime pay, bonuses, and other income sources. It also shows your deductions, such as taxes, insurance premiums, FICA tax, and other withholdings. Pay stubs also display your net or take-home pay after all the deductions.

A pay stub is a document the employer provides to the employee, usually given with each paycheck. This document includes:

- Total hours worked

- Federal, state, and sometimes local tax deductions

- Pre-deduction gross earnings

- Additional deductions, including your insurance premiums

- The final net pay you receive

Employees are entitled to a pay stub every payday as a transparent record of their earnings and deductions. Employers need to ensure that all the information on the paystub is accurate and up-to-date to avoid legal issues. The information should also match the W-2 Form so taxes can be filed accurately.

What is an Online Paystub Generator?

An online pay stub generator is a user-friendly digital platform that simplifies the creation of paystubs. Users can input their payment details, such as hours worked and hourly rate, and the generator calculates gross pay, deductions, taxes, and net pay, producing a professional-looking paystub document. This tool offers convenience, accuracy, and time-saving benefits for individuals and businesses needing to generate paystubs efficiently.

Generate Online Paystubs in Seconds to Prove Your Income

Are you tired of spending hours creating pay stubs to prove your income or employment? Our online pay stub generator calculates professional-looking pay stubs in PDF format in seconds. With just a few clicks, you can have all the information you need to verify your income and employment ready to go.

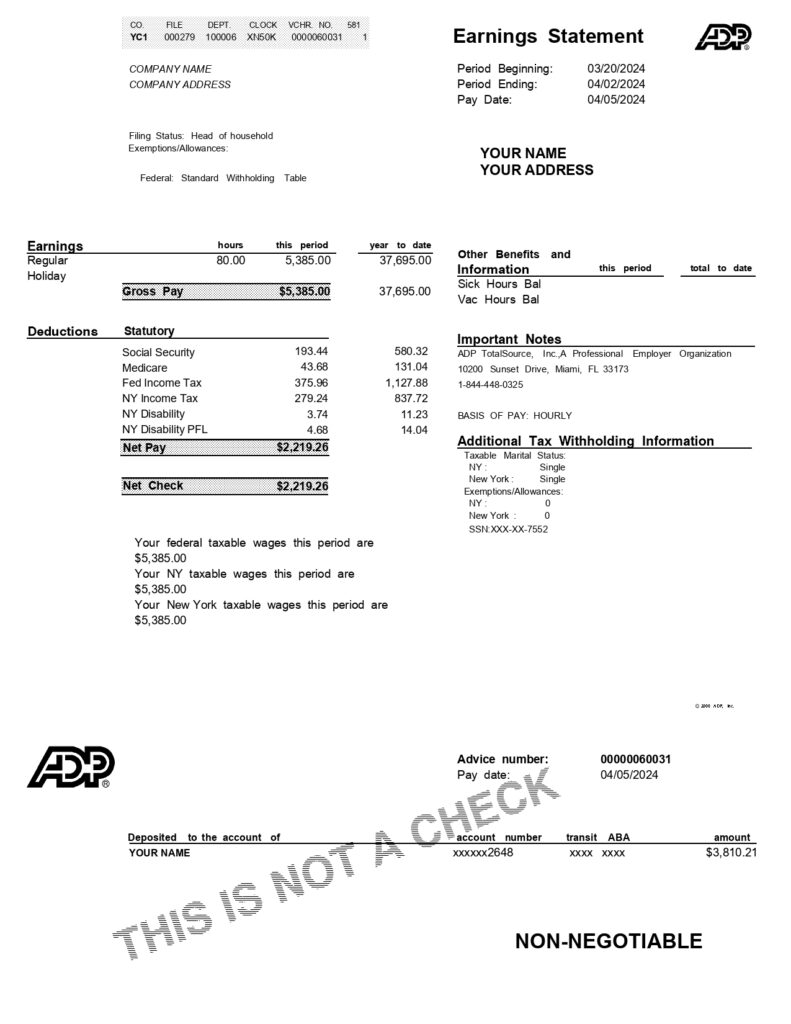

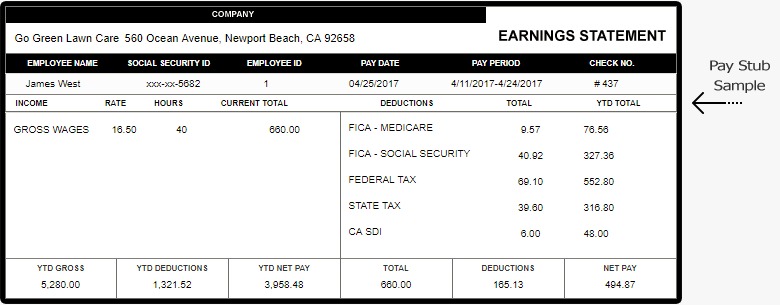

PayStub Template-C

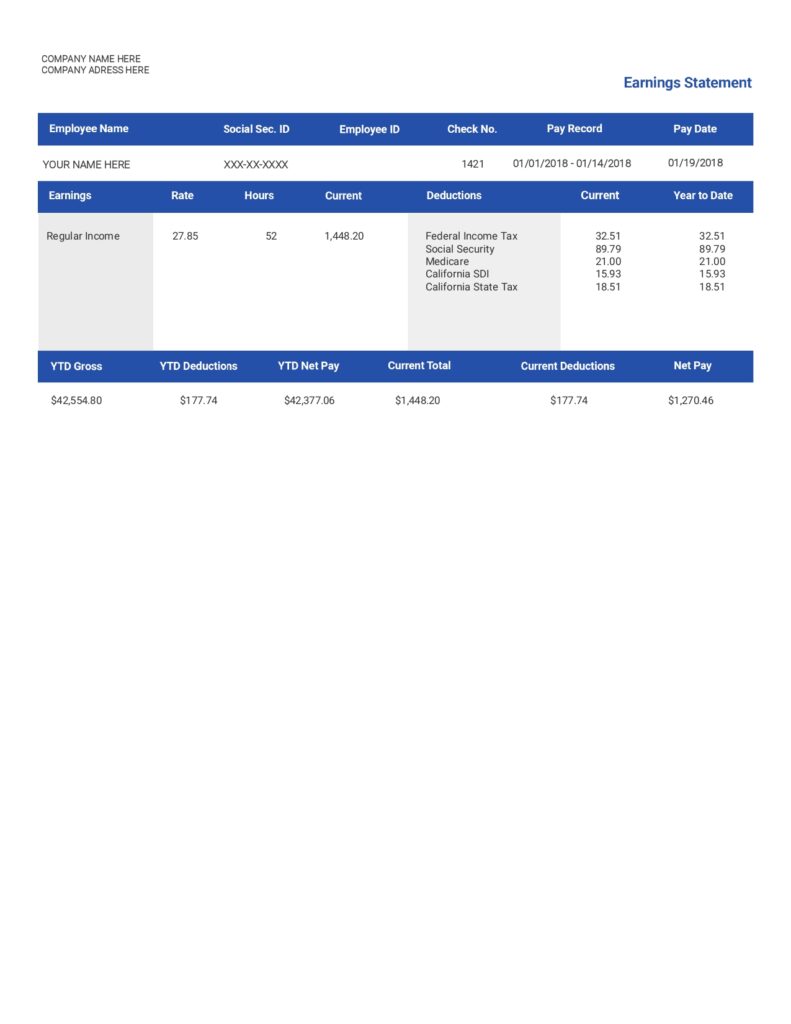

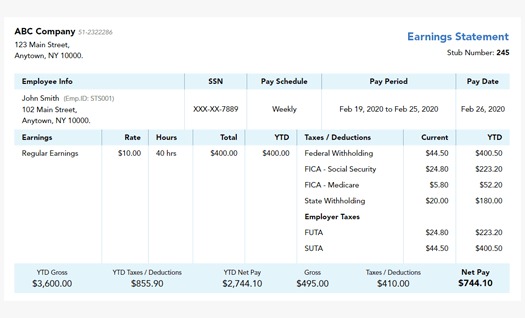

PayStub Template-D

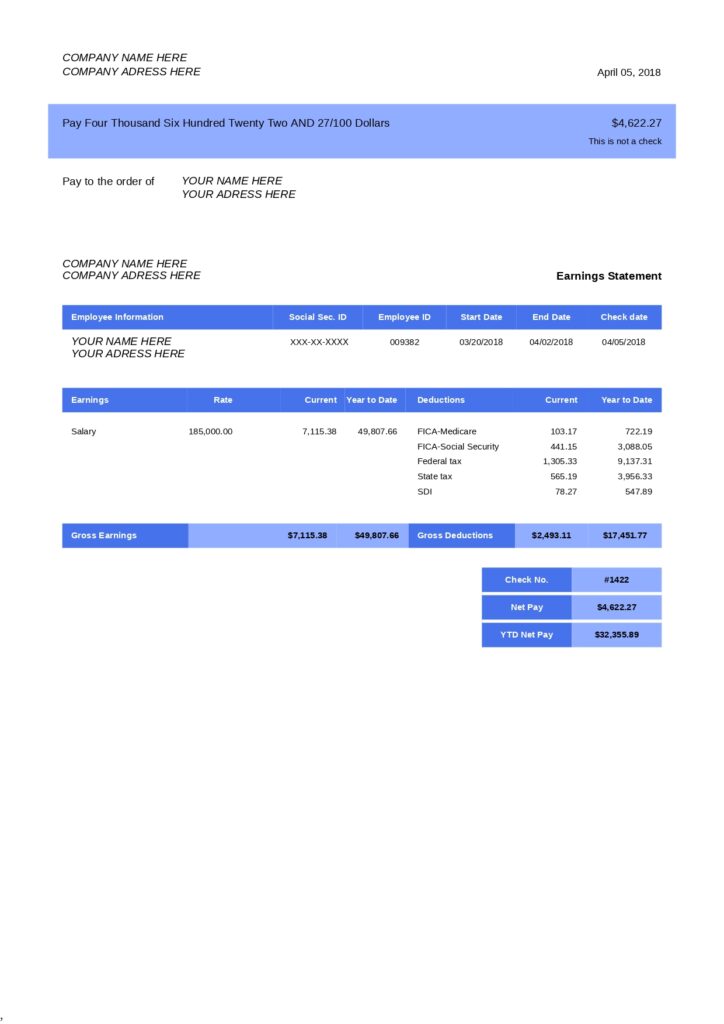

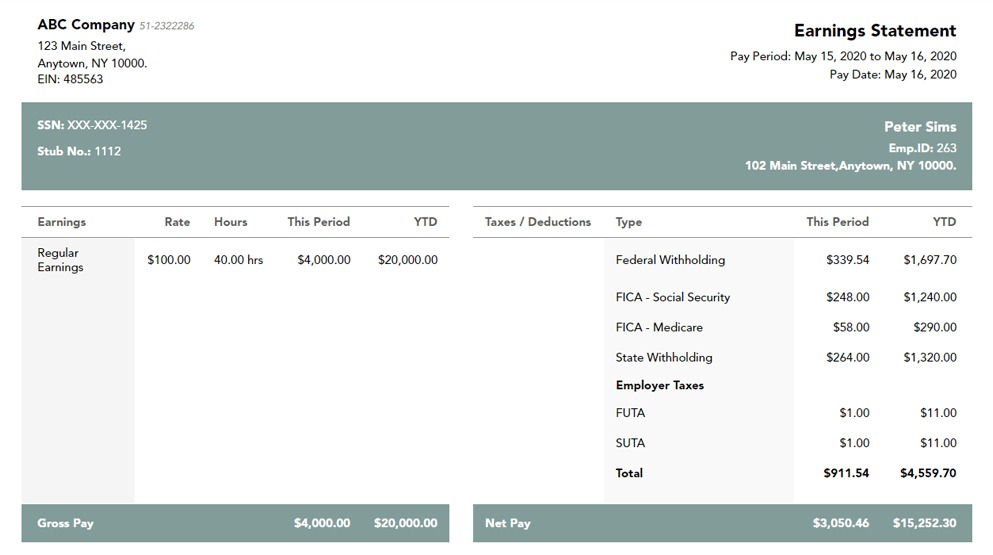

PayStub Template-E

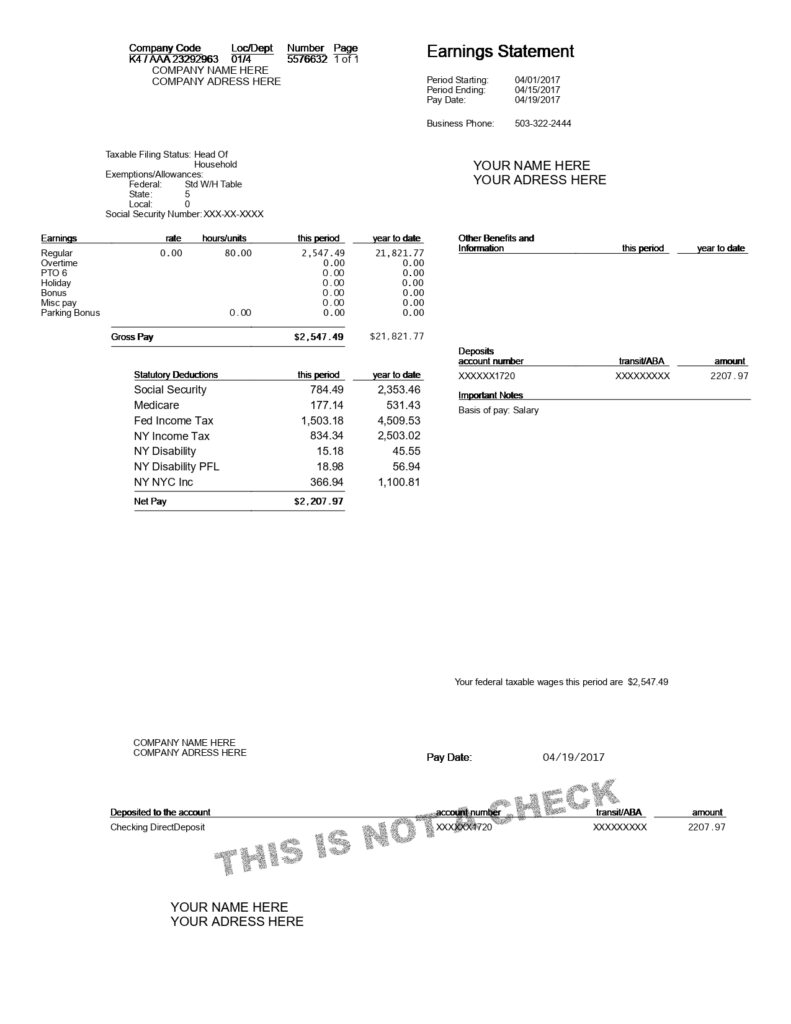

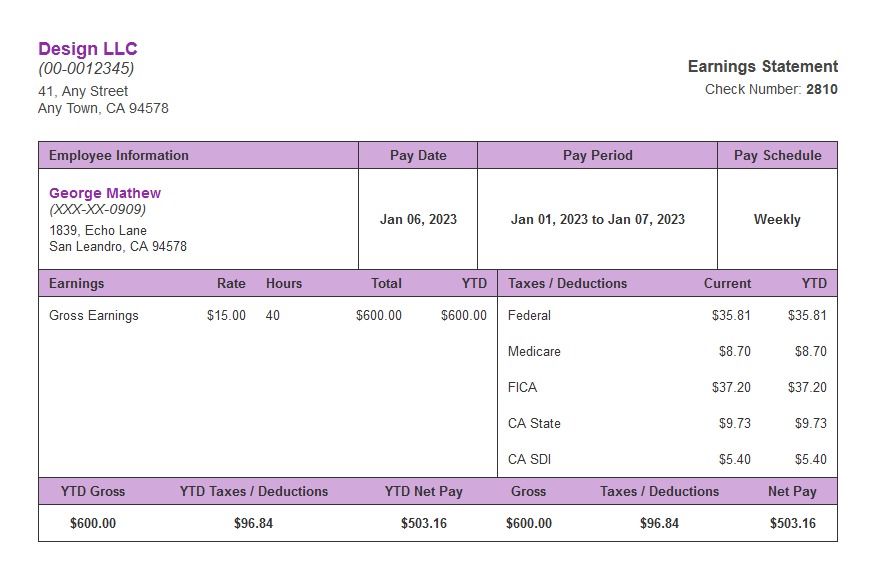

PayStub Template-F

Order Form

Please complete this form if you need to place an order for pay stub. Ensure the form is filled out before proceeding to the Check Out.

Why Create Pay Stub with Paper Work Master?

Auto Calculations

Creating accurate pay stubs can be time-consuming and prone to human error. With Paper Work Master, all calculations are automated, ensuring that your employees receive accurate pay stubs every time.

Built-In Templates

Our pay stub generator comes with pre-designed templates that you can customize to fit your business needs. This makes it easy to create professional-looking pay stubs without the hassle of designing them from scratch.

Secure and Reliable

We take security seriously, which is why all our data is encrypted to ensure the safety and privacy of your employee's information. Our platform is also reliable, ensuring that your pay stubs are always accessible for you and your employees.

How Does Our Pay Stub Maker Work?

Step 1: Add Company and Employee Details

Just choose your payroll check template and fill in the company name, address, employee information, and salary details to create a pay stub in seconds.

Step 2: Enter Payroll Details

Enter employee hours, overtime, commissions, bonuses, or other earnings. Our paystub maker will automatically calculate your net and gross earnings.

Step 3: Select the Number of Pay Stubs

Select the number of pay stubs you want to create and preview the final PDF before purchasing it.

Step 4: Download and Print

Once you have reviewed and finalized your pay stubs, download them as a PDF file. You can then print them for distribution or send them electronically to your employees.

Who Requires a Pay Stub?

A pay stub is essential for any employee or independent contractor who needs to prove their income or employment. This includes:

Full-time/ Part-time Employees

Full-time and part-time employees require pay stubs when they’re looking to make significant financial decisions or transactions. For instance, when applying for a mortgage or a car loan, financial institutions request pay stubs as proof of stable income.

Likewise, renting an apartment often requires evidence of employment, making pay stubs necessary for verifying a potential tenant’s financial stability.

Furthermore, pay stubs are crucial for full-time and part-time workers when managing their taxes. They provide a detailed record of earnings and deductions throughout the year, simplifying tax preparation and ensuring accuracy in reporting income to tax authorities.

Independent Contractors

Independent contractors also benefit significantly from maintaining accurate pay stubs. Unlike traditional employees, contractors often manage their financial records and are responsible for their tax obligations.

Contractors typically receive a 1099 Form from each client outlining the total payment made during the tax year. Comparing the information on the 1099 forms with their pay stubs allows contractors to ensure all payments are correctly reported and matched.

For instance, if a client claims to have paid $30,000 for services rendered, but the contractor only received $25,000 according to their pay stubs, they can address any discrepancies with their client and seek accurate payment reporting.

Self-employed Individuals

Self-employed individuals may also need pay stubs to prove their income when applying for loans or managing their taxes. Accurate pay stubs are vital in ensuring timely and correct payments as they are responsible for calculating and paying their taxes.

For example, if you run an INC or LLC, you need to demonstrate the company’s income and your personal earnings. Pay stubs provide an easy way to track personal income separately from business profits, simplifying tax preparation.

Employers

Employers must create pay stubs for employees to keep precise records and follow labor laws. Timely and accurate pay stubs also foster trust between employer and employee.

Some states require employers to provide employees with physical or electronic pay stubs, ensuring transparency and compliance. Creating pay stubs with a professional look and accurate information is crucial to maintaining good employer-employee relationships. Employers can use pay stub template generators to create employee pay stubs easily.

From Renting to Banking: Where Pay Stubs Matter?

While pay stubs are essential for various financial transactions, there are specific situations where they are absolutely necessary:

- Applying for a loan or mortgage: Lenders often require pay stubs to verify your income and employment before approving a loan or mortgage.

- Renting an apartment: Landlords may ask for pay stubs to ensure you have a stable income to cover rent payments. It also demonstrates your financial responsibility when managing rental payments.

- Applying for government assistance: Pay stubs are necessary to prove your income level and eligibility when applying for government programs such as food stamps or housing assistance.

- Filing taxes: Pay stubs provide a detailed record of earnings and deductions, making them critical for accurate tax preparation and filing.

- Visa or immigration applications: Pay stubs may be needed to prove your employment and income status when applying for a visa or immigration.

Disability: If you want to file a lawsuit for an injury that prevents you from working, pay stubs can prove your income before and after the accident. This information is crucial in determining the compensation you may receive.

What Information is included in a Pay Stub?

The specific information on a pay stub may vary depending on the employer and the state’s labor laws. However, here are some common elements to look out for:

- Employee Information includes personal details such as name, address, and employee ID number.

- Employer Information: This section provides key details about the company, including its name, address, and federal tax ID number.

- Pay Period: This indicates the period for which the employee is paid, typically a week, two weeks, or a month.

- Wages: This section provides information on the employee’s gross and net earnings and any overtime or bonuses earned.

- Taxes: All taxes withheld from the employee’s paycheck should be listed here, including federal, state, and local taxes. This section also includes Social Security and Medicare contributions.

- Deductions: Employee benefits such as health insurance, retirement plans, and other deductions are listed in this section.

- Year-to-date: This section provides a year-to-date summary of the employee’s earnings, taxes, and deductions.

Understanding Pay Stub Components: Key Issues for Workers

Understanding the information on your pay stub is essential, as it helps you keep track of your earnings and deductions. Here are some key components to look out for:

- Gross vs. net earnings: Gross earnings refer to the total amount earned before any taxes or deductions are taken. Net earnings, on the other hand, is the amount of income received after all taxes and deductions are applied. The worker must ensure that the net earnings match the amount stated on their paycheck.

- Current period vs. year-to-date wages: The pay stub should indicate the current period’s wages and the total earnings for the year. This information helps employees track their progress and ensure that all taxes and deductions are accurately applied.

- Hourly vs. salary: The pay stub should indicate whether the employee is paid hourly or receives a salary. This distinction affects how taxes and deductions are calculated.

- Taxes and deductions: Pay stubs should clearly break down all taxes and deductions taken from an employee’s earnings, including federal, state, and local taxes, insurance premiums, and other benefits. Understanding these deductions can help employees plan for their financial obligations.

- No. of pay period: It is essential to note how often employees receive pay stubs, which can vary depending on the employer. Some may receive them weekly, bi-weekly, or monthly. It helps employees keep track of their earnings and plan for expenses accordingly.

What are the Requirements for Pay Stubs in Different States?

There is no federal government law that all states are required to follow regarding pay stubs. However, most states have their own regulations that employers must adhere to. Some states require physical or electronic pay stubs, while others do not have any specific requirements.

Before processing your paycheck stub, you need to verify if your current state is opt-in or opt-out. This status can determine whether you are eligible to receive electronic pay stubs.

Opt-in States

The employer must provide a paper version of the pay stub for opt-in states. However, an employer must digitally provide the electronic pay stub if the employee requests it.

The opt-in states include California, Iowa, Connecticut, Massachusetts, North Carolina, Vermont, Washington, Texas, New Mexico, Maine, and Colorado.

Opt-out States

An employer needs an employee’s consent to electronically give pay stubs in opt-out states. However, the employer can upload the digital version of the pay stub on an employee’s online portal so that they can access it anytime from anywhere.

However, the employer must stick with the paper version in case of any objection. Some of the opt-out states are Mississippi, Alabama, South Dakota, Florida, Arkansas, Georgia, Tennessee, and Ohio

Complex States

Some states like Hawaii, Oregon, Minnesota, and Delaware have complex requirements compared to opt-in and opt-out states. You need to determine the state law for pay stubs for your specific state:

- Access states: You can provide a paper or digital version of the pay stub for both access states.

- No requirements: Employers must not provide pay stubs for states like South Carolina, New Hampshire, and Virginia.

- Print/access: In states like Rhode Island, North Dakota, Nebraska, and Indiana, employers can provide pay stubs in physical or digital format. However, employees should have access to print or view pay stubs online.

Suppose your business operates in multiple states across the U.S. In that case, it’s important to understand that each state may have unique legal, tax, and regulatory requirements. As such, it’s crucial to stay up-to-date on any changes in laws or regulations that may impact how you handle pay stubs for your employees.

How Does an Employee Obtain a Pay Stub?

There are a few ways that an employee can obtain a copy of their pay stub:

Direct Deposit

Instead of using physical check stubs, many employers now offer direct deposit as a payment method. This means that employees receive their pay directly into their bank account and can view their pay stubs through an online portal or email.

Online Portal

Some employers may also provide access to an online portal where employees can view and download their pay stubs anytime. This is especially useful for remote workers who may not have access to a physical pay stub.

Physical Copy

Employers can provide employees a physical copy of the pay stub without direct deposit or online access. This may be given along with the paycheck or mailed to the employee’s address.

Check Stub Maker

By using a check stub maker like Paper Work Master, employees can also access their pay stubs online or through email. This makes it easy for them to keep track of their earnings and plan accordingly. Just choose your payroll check template and fill in the required information, and our paystub maker will take care of the rest!

It’s essential to understand your company’s policies and procedures for obtaining pay stubs as an employee. If you are unsure, be sure to ask your employer for clarification. Access to pay stubs can help employees stay organized with their finances and make informed decisions about their spending and savings habits.

What are the Risks Associated with Fake Paystubs?

Creating fake paystubs is considered fraudulent and illegal. It can lead to serious consequences for both the employer and employee involved, including:

- Legal Consequences: Providing false or misleading pay stubs can result in legal action against the responsible individual. You may also face jail time of up to five years.

- Financial Consequences: Falsifying pay stubs may also lead to financial penalties and fines imposed by the government. Your credit card will also be declined, and you may lose your job.

- Damage to Reputation: Engaging in fraudulent activities can damage the reputation of both the employer and employee involved, making it difficult for them to secure future employment or business opportunities.

You can simply avoid these risks by using a reliable and secure pay stub maker like Paper Work Master to create accurate and legitimate pay stubs for your employees. This ensures compliance with legal requirements and builds trust and credibility within your workforce.

How to Differentiate Between Fake and Real Pay Stubs?

Differentiating between real and fake pay stubs can be crucial for employers, lenders, and rental agents. A genuine pay stub will display consistent formatting and fonts across all sections. In contrast, a fake pay stub might have irregularities, such as mismatched fonts or poor alignment due to manipulation or photoshopping.

Real pay stubs contain accurate and verifiable information regarding an employee’s earnings, taxes, and deductions. However, fake pay stubs often have rounded numbers or incorrect calculations that don’t align with standard tax rates or pay cycles.

Another tell-tale sign of a counterfeit pay stub is the presence of spelling errors or incorrect terminology, as legitimate payroll providers ensure error-free documents. Moreover, genuine pay stubs will have a level of detail, including year-to-date figures, precise contributions, and deductions, which fake pay stubs often overlook or inaccurately represent.

When generating a pay stub for your employees, always ensure the information is accurate and consistent with their employment records. Also, avoid illegitimate and unverified online sources claiming to provide “real” pay stubs, which can potentially lead to legal and financial repercussions.

Mistake to Avoid When Using a Pay Stub Maker

To ensure accurate and reliable pay stubs for your employees, it’s essential to avoid these common mistakes when using a paystub maker:

- Not Double Checking Information: Even with the convenience of automated calculations, it’s important to double-check all information entered into the pay stub generator. This includes employee details, earnings, and deductions, as errors can lead to inaccurate pay stubs.

- Using Incorrect Payroll Period: Select the correct pay period (weekly, bi-weekly, monthly) when generating pay stubs. Using the wrong period can result in incorrect calculations and discrepancies between actual earnings and reported figures.

- Not Including All Earnings: In addition to regular wages, make sure to include any additional earnings such as commissions, bonuses, or overtime hours. This ensures the pay stub accurately reflects an employee’s total income for a period.

- Forgetting to Deduct Taxes: Income taxes and other deductions must be considered when generating a pay stub. Failure to do so can result in discrepancies between reported income and actual taxes owed, leading to potential legal and financial consequences.

- Not Saving Copies: It’s important to save copies of all pay stubs for your records. This helps with record keeping, tax filing, and any discrepancies that may arise in the future.

Employers can ensure accurate and legitimate employee pay stubs by avoiding these mistakes and utilizing a reliable pay stub maker. This not only promotes financial transparency but also maintains compliance with legal requirements. So, choosing the right payroll check template when using a paystub maker is essential to avoid any errors or discrepancies.

How can I Generate Pay Stubs Online?

Generating pay stubs online with Paper Work Master is quite easy. Our user-friendly website lets users choose from different Paystub templates (A, B, or C) and simply input the necessary information.

Here is a step-by-step guide to creating paystubs:

- Fill in the required information in the form, such as your name, complete address, company and wage details, etc.

- Choose the desired pay stub template (A, B, or C) and click on it.

- Enter the amount per check (after tax deductions)

- Choose between weekly, bi-weekly, or monthly pay periods.

- Double-check all the information for accuracy.

- Choose your desired payment method (Venmo, Zelle, Paypal, Cash app)

- Click on submit to generate your pay stub.

Once you have submitted all the necessary data, our team will manually create your pay stub with attention to detail. We strive to provide accuracy and compliance with financial standards. After the process is complete, the finalized pay stub will be sent directly in PDF via mail.

FAQ

Yes, as long as the information entered is accurate and verifiable, pay stubs created with reliable online generators are legally valid.

Most online pay stub generators offer customizable templates that allow you to modify the layout and design to match your brand or business needs.

In most states, employers must provide pay stubs at every pay period. However, checking with your state’s labour laws for specific requirements is important.

Reputable online pay stub generators use secure servers and encryption to protect sensitive employee information. It’s important to choose a trusted and reliable provider when using these services.

Yes, you can use an online pay stub generator to create pay stubs for independent contractors. However, label it as a contractor pay stub instead of an employee pay stub and provide accurate earnings and deductions information.

Most online pay stub generators allow users to download the pay stub as a PDF file, which is readily accessible and printable for easy distribution. Some may also offer other formats, such as Word or Excel.